-

Loans-Credit Lines

Poor Credit Score? No Problem – From 5.4% APR, Up to $50,000

A considerable percentage of Americans have a bad credit rating, and the bad credit loan services is a huge relief…

Read More » -

Money-Finance

The Paycheck Protection Program? Who Qualifies, When Did it Expire and Will Another Program Similar be Approved?

Data Source: SBA – Federal Small Business Agency The CARES Act includes $350 billion for federally guaranteed loans for small…

Read More » -

Credit Building

Easiest Credit Cards to Get Approved For | BadCreditWizards.com

When you try to get approved for a credit card you can run into a bit of a catch-22 if…

Read More » -

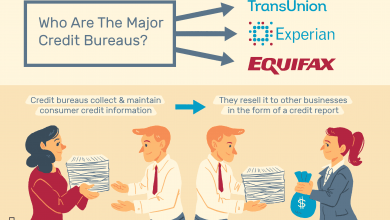

Credit Building

Credit Scores & Credit Reports- How All Three of Your FICO Credit Scores are Calculated

The three digit number on your FICO score has a huge impact on your life. It is important for you…

Read More » -

Credit Card Reviews

Bank of America Cash Rewards Credit Card – Is It Right for You?

With so many cash rewards credit cards to choose from, it’s not easy picking the one that will work best…

Read More » -

Credit Building

Credit Management Made Easy – Free, Quick And Easy

A high credit score automatically increases your chances of getting approved for just about anything and if your score crosses…

Read More » -

Coronavirus

The Coronavirus Deals the Largest Blow to the United States Economy in Recent History

The Commerce Department announces that GDP fell 9.5% in the second quarter just before aid for 17 million unemployed expired.…

Read More » -

Credit Building

Barclaycard Mastercard Credit Card Offers – Arrival Plus or No-Fee Version Compared

Barclaycard offers a huge variety of credit cards for users. They currently offer nineteen cards according to their site, so…

Read More » -

Credit Building

Get Pre-Qualified Auto Loans For Bad Credit In Under 2 Minutes

Shopping for a car with bad credit is not going to be easy since your credit score has a lot…

Read More » -

Coronavirus

COVID-19, a Serious Threat that “Could” Affect Marine Species Across the Globe is Now Being Researched

In unprecedented times, with the ongoing COVID-19 pandemic, which has affected public health, the economy and society on a global…

Read More » -

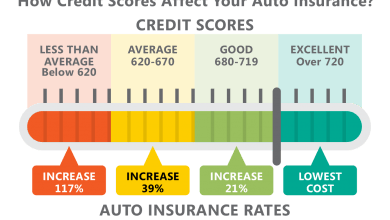

Credit Building

How Much Does Credit Score Affect Auto Insurance Rates?

There is a little-known fact about our insurance premiums and our credit scores. Depending on our credit score, this number…

Read More » -

Credit Building

Get Approved For A Credit Card With Fair/Average Credit

Having average credit is certainly a normal and even admirable thing these days. It is so easy to create debt,…

Read More » -

Credit Building

American Express “Blue Cash Everyday” Gives Cash Back EVERYWHERE!

If you’re tired of a cash rewards credit card that limits you to revolving purchase categories every quarter, then the…

Read More » -

Coronavirus

Extending Help to Homeowners Impacted by COVID-19

In New York city, Mayor Bill DE Blasio became the last city official to call for a rent freeze, joining…

Read More » -

Loans-Credit Lines

Bad Credit Loans and Emergency Loans – Where to Get a Fast Loan

Doesn’t it sometimes feel like your bad credit follows you around like a scarlet letter, calling you out to creditors…

Read More » -

Credit Building

Filling Out Credit Card Applications and How to Get Approved

Credit cards are something everyone should consider owning because they offer a lot of opportunities when used right. What credit…

Read More » -

Loans-Credit Lines

Loans For All Credit Scores. Personal, Student, Home, Auto & More

Many people with bad credit assume that they are resigned to renting for the rest of their lives. Without looking…

Read More » -

Money-Finance

What Are the Different Types of Bankruptcies? Chapter 7 vs. Chapter 13 vs. Chapter 11 Bankruptcy

If you are behind on your credit card payments, car loans, or home loans, there are many options to try…

Read More » -

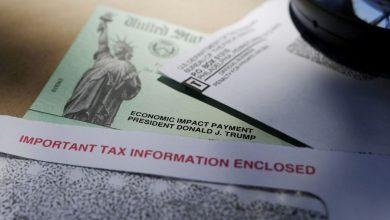

Coronavirus

Stop Waiting for a Second Round of Economic Stimulus Checks

Millions of Americans continue to receive the unemployment benefit and financial aid check as the United States economy continues to…

Read More » -

Credit Building

Options For Refinancing Your Home With Bad Credit

It’s true that having bad credit can make finding home refinancing options difficult but that doesn’t mean you can’t still…

Read More » -

Coronavirus

How to Get a Coronavirus Stimulus Check Without Up to Date Tax Filings

The Internal Revenue Service (IRS) has delivered more than 160 million stimulus checks to federal aid recipients, and while a…

Read More » -

Coronavirus

US Economy Gained Ground in the Recovery of GDP in the 3rd Quarter

United States economy grew 7.4% in the third quarter of the year compared to the previous three months. The gain…

Read More » -

Coronavirus

Why Economic Stimulus Checks, Aid To Small Businesses, And Reopening Are Not Enough To Rescue The United States Economy

The coronavirus pandemic spread through the American economy at an incredibly fast rate, so fast that it has been difficult…

Read More » -

Money-Finance

Homeowners Insurance For Bad Credit- Get A Low Rate Insurance Policy with Bad Credit

A home insurance policy can cover your home of course but home insurance coverage does come with a cost and…

Read More » -

Credit Card Reviews

ABOC Platinum Rewards Mastercard W/ No Annual Fee & Low Intro APR

With so many credits cards out there, it can be tough to find one that will be the most beneficial…

Read More » -

Credit Card Reviews

Chase Freedom Unlimited 1.5% Cash Back Rewards Card – Bad Credit Wizards Review

There are a ton of options out there when it comes to finding a great credit card. But because of…

Read More » -

Credit Card Reviews

The Best Credit Cards For Poor Credit That Rebuild or Establish Good Credit History

Having poor or no credit can be very difficult for a person. There are a variety of reasons why this…

Read More » -

Credit Card Reviews

Lowe’s Credit Card- Complete Your Next Project With Flexible Payments

Trying to apply for a credit card is much easier than one would think. When applying for most credit cards,…

Read More » -

Money-Finance

Financial Predictions for the Time of the Elections This 2020, Which Investments to Get into or out of Before it’s too Late

In the United States, Allan Lichtman was dubbed the “Nostradamus” of presidential elections: historian, American University professor, and political analyst,…

Read More » -

Loans-Credit Lines

Key Factors When Applying For A Mortgage- Get Approved for a Home Loan with Bad Credit

The American Dream always begins with home ownership. Finding a lender with the lowest rates for your home loan can…

Read More » -

Credit Building

Your First Credit Card – What You Should Know Before Choosing Your First Credit Card

Before applying for a credit card you must first decide what type of credit card you need because there are…

Read More » -

Credit Building

Choosing the Best Starter Credit Card – The Best Starter Credit Cards & How To Use Them

If you are new to credit and have no credit to your name or are a beginner with limited credit,…

Read More » -

Credit Building

Difference Between Secured And Unsecured Credit Cards- Applying For These Cards

Whether you are applying for a credit card for the first time or are considering opening another credit card account,…

Read More » -

Credit Building

Citi Double Cash Credit Card: 2% Cash Back Option- Is it Too Good To Be True?-

Are you looking for a new credit card? Do you like getting cash rewards? What about double cash back? Then…

Read More » -

Credit Card Reviews

What Is A Travel Credit Card And Why Do I Need One?

If you’ve spent much time perusing the travel or credit card news, you’ve likely heard about travel credit cards. Some…

Read More »