Best Car Refinance This 2022 – From 2.59% APR | Fast Approval

Your Top 5 Car Refinance Rates - Rates as Low as 2.49% APR

Refinancing your car may be necessary if you are feeling a severe crunch from high-interest rates, and it seems as if not much of your funds are going to the principal. Auto refinancing can be a quick and easy process when you have all your documents and information ready for the application. What you’ll want to do ideally is refinance your car loan so you can get a lower monthly payment and interest rate plan. The following are the best companies to refinance your vehicle and the steps will be covered in detail.

Beginning the Process of Refinancing Your Vehicle

The first thing that you want to do to refinance your vehicle is is gather all of your information together. That’s one of the first steps. You’ll need to know your vehicle’s identification number, mileage, license plate number and any other information that can help the prospective lender to identify your car. The next thing you will need to do is contact some of the top auto refinance businesses and complete their applications. They’ll want to know your employment information, address and some other details. Just be as honest and forthcoming as possible with them, and they will help you. Contact your favorite provider today and get your car refinanced to an agreement that works for you.

What Makes A Good Refinance Company?

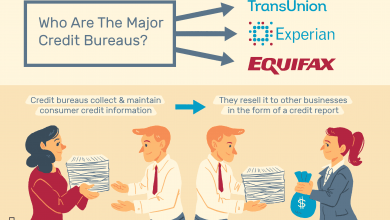

A good refinance company will have competitive rates, friendly customer service, and a solid and positive reputation. When you are trying to refinance your auto loan having a high credit score can make it easy to find good rates. You should research and compare at least three providers so that you can make the best possible choice when you decide which one is the best. Consumers have several options when it comes to refinancing a car. They can use banks, credit unions, title lenders or brokers.

Banks Offer Competitive Auto Refinancing Options

Wells Fargo is one of the most popular and trustworthy financial organizations offering competitive rate auto refinancing. The company has an easy auto refinance application that an interested person can access online. The system will provide the answer within a few short minutes, and the application can save that person tons of money on the current loan. Capital One is popular for its credit cards and easy going qualification criteria. However, Capital One also offers some attractive rates that are between 2.9% and 12%. The average rating is 3.8 out of 5 stars from people who have used this company to refinance their loans. US Bank has a rating of 3 out of 5 stars. The consumers who praised this company said that they received some amazing rates on their loans. In addition to the amazing rates, they appreciated the customer service that they got.

When to refinance your car loan

You are probably asking yourself, “should I refinance my car loan?” Well, it gives you a chance to save on money. To be able to do that, you should take advantage of some particular situations. If you take advantage of the following situations, you will stand a chance to make huge savings.

- When there is dropping rates- Monetary policies make interest rates on loans to vary considerably. The Federal Reserve alters monetary policies and consequently, interest rates on various consumer loans fall or rises. For instance, interest rates have risen twice this year. Therefore, you should watch out for the time when the rates are at in their lowest and take up the opportunity. With this approach to “should I refinance my car loan” question, you are started on the right foot.

- When you want to improve on a “dealer-sourced” car loan– If you got your car through a dealership, you were probably charged higher rates than you should have been charged. This is because the excess of the charges goes to the dealership after lenders have taken their cut. If that is how you financed your car, compare the rates to those of other financial institutions and choose an offer that promises good savings.

- When you want to reduce your monthly payments- You could be in financial trouble and you want to cut down on any cash outflow. Well, car loan refinancing being a life preserver, you are able to lower your monthly payments. That case necessitates the need for refinancing a car loan. As much as your monthly payments will be reduced, the total amount of the payments will be more at the end of the life of the refinancing loan.

- When you want to buy a car you’re leasing- Usually, dealers offer the option of buying a car at the end of the lease period. In that case, you can seek to refinance loan to enable you to buy the car immediately after the end of the lease period. For this situation to make more sense, you will need to find out if the total cost of buying the car is less than the cost of extending the lease or leasing another car.

- When your credit score has improved- If you pose the question again, “when should I refinance my car loan?” another right answer would be when your credit score has improved. After committing yourself into building your creditworthiness, you are likely to enjoy its fruits as financial institutions can offer you lower interest rates on a refinance loan.

To get you started, the following important tips and facts when refinancing your car loan will be helpful.

Important tips and facts when refinancing your car loan

- What is motivating you to refinance your car loan?- Ask yourself the question before visiting financial institutions and determine the main objective that is driving you into refinancing the car loan. If you are making monthly payments of the current loan comfortably, go for lower rates when refinancing and maintain the monthly payments to enable you to repay the full refinance loan in a shorter period. Alternatively, if you’re on a tight budget, you should ask for an extension of your loan repayment period. Consequently, you will be able to make lower monthly payments for a longer period, although, it will expose you to more interest.

- Look for a lender who will offer lower rates- Talk to your current lender and find out what they can offer before applying for a loan with another lender. The lending company may be interested in retaining you owing to the fact that they already have your track of financial information on file. Afterward, make an effort to research on companies and compare interest rates offered by a number of companies. That will give you many options to choose from. Also, you might land on a loan with friendly interest rates if you explore local credit union options.

- Consider the value of your car- If you have an underwater car, it will be difficult to get a lender to refinance your car loan. Underwater is a term that denotes a situation where a car loan balance exceeds the worth of your car. In the case of an underwater car, refinancing your car loan is a risky endeavor to lenders since if you default on your loan, the sale of your car won’t recover their full amount of money you owe them. If this case applies to you, you will need to make some additional payments on your current loan to prevent it from going underwater. This will enable you to get lower rates on refinance car loan.

- Choose the right moment to refinance- As discussed earlier, there are favorable situations when refinancing car loan makes the most sense. Therefore, before embarking on a journey to look for a lender, ensure it is the appropriate moment to act.

- Watch out for early termination penalties- Before you start refinancing, check the terms and conditions of your current car loan. There could be early repayment penalties. It is not that it will prevent you from refinancing, but it will add an extra cost to your refinancing costs. For instance, if your car loan is $9,500 and there is a $500 early repayment penalty, do your car refinance calculations as if you are borrowing $10,000 to allow you gauge on the amount of money you will actually save.

With the above tips and facts when refinancing, you are set to embark on a journey to get the right car loan refinancing option. But first, if the “what do I need to refinance my auto loan?” question is lingering in your mind, the following guidance can help you get started.

What Do I Need to Refinance My Auto Loan?

- Relevant documents- Well, even before ensuring you have access to the necessary documents, you need to know your existing monthly payment and the balance, the loan term, interest rate of the existing loan as well as your lender’s contacts. Go ahead and prepare your driver’s license, social security number, vehicle identification number as well as pay slips or proof of employment for submission.

- Credit score- You will need to establish your creditworthiness. Find out where you stand and if you have a credit score of over 600, you can get a car refinancing loan that suits your needs.

- Application– Obviously, you will have to get down on paper and do the application. Usually, the application process is simple and free. It is advisable to submit all your loan applications within 14 days to reduce the impact they have on your credit score. You can also apply to various companies in an effort to get offers on different interest rates and give you many options to choose from.

- A calculator- You are required to enter your current loan information to the calculator. The information includes the amount of your current loan, interest rate as well as the length of the loan. Afterward, enter the amount that is owed as well as the period in months that is required to finish repaying the balance. Then, fill in the months you expect to take to repay the total amount of the refinancing loan and also, the interest rates that you would prefer. After that is done, the calculator will reflect the monthly payments you will need to make as well as the total savings you will make both monthly and for the whole life of the loan. At this point, you will establish if you are going to make any savings at all. Additionally, it is the right moment to determine the value of your car and compare it to the remaining balance of the existing loan.

- The paperwork- After you have chosen your lender and determined that the refinancing loans will help you make low monthly payments, you are set to go ahead and to finalize on the contract with your new lender. You can expect to sign new loan documents detailing interest rates and loan term information.

Lending Tree & Nationwide Auto Refinancing

Lending Tree is a site that connects consumers with the best companies that can help them to fulfill their needs. The customer types in his or her information and specifies that an auto loan refinance is what he or she desires. The offers come in according to the information, and then the consumer can pick which one is best. The Nationwide Bank is a household name. Many people go to Nationwide for insurance and other products. Customers rate this firm highly because of its professionalism and tenure.