Get Approved For A Credit Card With Fair/Average Credit

Having average credit is certainly a normal and even admirable thing these days. It is so easy to create debt, and it happens to the best of us. When hard times hit, it can seem like there is no other choice but to use credit cards just to survive. In this way, maintaining a decent score should be commended. With all of these fantastic cards for fair to average credit, which one should you choose? The decision to apply for a card needs to be based on what you specifically are looking for. The aforementioned companies, as well as the ones that were not included on this list all, offer super options of credit cards with benefits that appeal to all. Whatever card you choose will be a great tool to increase your fair credit or rebuild credit to help you have a stronger credit profile every day.

Credit Cards For Those With Average Credit

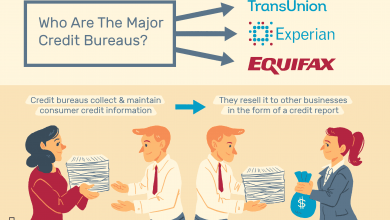

Who knew that a simple three-digit number could dictate so much about a person’s life? That is the case for the almighty FICO credit score. This score, compiled by the rating agencies, lets potential lenders know how creditworthy you may be based on your past debt repayment behaviors. The higher the score, the more likely you are to qualify for more borrowing.

What It Is Like To Just Be Average

The FICO credit score ranges from 300 to 850. Plenty of people fall into the category of having average credit. In other words, they probably have a score that is somewhere in the six-hundreds. This means that they may be carrying more debt than what is prudent, or they may have missed some payments in the past or a combination of both of those things. Individuals who have this kind of situation will want to know about cards that approve fair or average credit and some facts when using these cards. These are the types of credit cards that will approve of these types of debtors, so those borrowers need the facts.

Interest Rates For These Cards

Plenty of individuals with average credit want to know the facts when using these cards in terms of what they charge in interest. There is some good news on this front. A lot of cards that approve fair or average credit actually offer an introductory interest rate of zero percent for a certain number of months. The exact offering is going to vary from lender to lender, but it is not out of the question to have zero percent interest for fifteen months or more. It almost sounds too good to be true that a credit card company would give a borrower the opportunity to pay no interest on their purchases for any length of time. However, that is what these cards do. Their strategy is to create loyal customers that they can charge interest to at a later date. Also, as the cardholder, you have to be mindful to pay your bill on time still in order to avoid late fees and penalties.

Are There Restrictions?

One of the facts when using these cards to know is that there are not really any restrictions that you would see with these cards that you wouldn’t find with any other card as well. Some people get anxious that they are going to be hit with certain barriers to their use of the card simply because they only have average credit. That is not the case. There may be some advantages to being someone with even higher credit in the form of higher credit limits and the like, but the credit card company is not going to restrict what you spend your credit on so long as it is legal.

Are There Things To Be Wary Of?

One of the things to keep an eye out with cards that approve fair or average credit are annual fees and opportunities for cash advances. An annual fee may be charged on any type of credit card if that card issuer spells out that this is what they are going to be doing in the cardholder agreement. However, the most likely set of creditors to do that are ones who issue cards that approve fair or average credit. They sometimes feel that they need a bit of an extra incentive to issue the card in the first place, so they may attempt to use an annual fee to boost their profits. You ought to mostly try to avoid those cards in favor of those with no annual fee.

Those Pesky Cash Advances

They may seem tempting at the moment, but borrowing cash off of your credit card can be an incredibly expensive proposition. You may end up paying a huge interest rate that you never anticipated having to pay. This is just not a good idea. With so many cards being focused on individuals with great to excellent credit, it can seem like a challenge to find the right card if you have achieved a fair to average credit score. Let’s take a look at some fantastic options for your next card:

- The Chase Slate Card

- The Capital One QuicksilverOne Card

- The Capital One Platinum Credit Card

The Chase Slate Card

The Chase Slate Card is really a brilliant card for the person with average credit. This card offers a variety of upfront features including the ability to transfer a balance for free if it is done within sixty days of the account creation. Also, for fifteen months, you can enjoy 0% APR, so you can use your card without having to worry about interest for that time. This card also offers a fantastic feature of no interest rate change if you miss a payment. Honestly, life happens, and not having to worry about an increased interest rate would definitely be a load off your mind. The Chase Slate Card offers no annual fee, so there is nothing to worry about except using your card responsibly and enjoying the benefits of rebuilding credit or sustaining credit. Last, but not least, you can have access to your credit score which will allow you to keep up to date with all the positive events that happen from your responsible card use. Lastly, this card offers fraud protection and alerts as well as purchase protection. This is a great card for anyone really, with fair credit to those with great or excellent credit.

The Capital One QuicksilverOne Card

The Capital One QuicksilverOne Card is a marvelous card in its own right for a variety of reasons. This card has some great upfront features including 1.5% cash back rewards for every single item or service you purchase. There are no categories or anything of the like. If you charge with it, you receive the rewards which never expire. How great is that? Plus, if you make the first five monthly payments on the Quicksilver One Card, you could be rewarded with a higher credit line. Increasing your spending power is definitely an incentive to make payments on time. You also always get access to Capital One’s unique CreditWise program which allows you to keep tabs on your credit score. With this feature, you can give yourself a pat on the back if you’re trying to rebuild credit and succeeding at doing so. Card users also enjoy a bunch of other features including fraud protection and security alerts, the ability to choose your due date, travel, and roadside assistance, and more. These aspects make for an excellent all-around card to take advantage of your hard work and give you great rewards.

The Capital One Platinum Credit Card

The Capital One Platinum Credit Card is phenomenal in its own right. This card offers simplicity which is never a bad thing.  First, you could get access to a higher credit limit in just five months of paying your first five monthly payments. So, you could increase your credit limit in no time and have higher spending power. Plus, this card offers no annual fee, which is wonderful because saving money is key to this game. With the Capital One Platinum Credit Card, you have protection from fraud which is so necessary for this day and age when corruption seems to be everywhere. You can breathe easy knowing that Capital One has your back and you will not be responsible for any unauthorized purchases made with your card. You will receive access to your credit score with this card as well, allowing you to watch your average credit transform into great to excellent credit or help you be able to see your progress as you rebuild credit. Additionally, you get a slew of other features including security alerts, the ability to choose your due date, travel, and roadside assistance, and more.

First, you could get access to a higher credit limit in just five months of paying your first five monthly payments. So, you could increase your credit limit in no time and have higher spending power. Plus, this card offers no annual fee, which is wonderful because saving money is key to this game. With the Capital One Platinum Credit Card, you have protection from fraud which is so necessary for this day and age when corruption seems to be everywhere. You can breathe easy knowing that Capital One has your back and you will not be responsible for any unauthorized purchases made with your card. You will receive access to your credit score with this card as well, allowing you to watch your average credit transform into great to excellent credit or help you be able to see your progress as you rebuild credit. Additionally, you get a slew of other features including security alerts, the ability to choose your due date, travel, and roadside assistance, and more.

Will I Automatically Be Approved?

Your approval odds increase with a higher credit score obviously. Lenders are always going to care about this, so you might as well get used to that fact. You should be working on building up your credit score as much as humanly possible in the meantime. You just never know if you will be approved if you just have poor credit. Most average credit borrowers can more or less guarantee that they will be able to get the cards that are targeted at people with their kinds of credit scores. Certain issuers may decide to get a little pickier if they happen to have an excellent rewards program or something of that nature, but most of the time the cards are going to be in the hands of those who have a credit score that is worthy enough to earn them.

No Need To Rush

Take your time to choose the right card for your particular needs. There is nothing that says that you must sign on to the first offer that lands in your mailbox or your inbox. Shopping around can reveal cards that have the best interest rates and the best rewards programs as well. You definitely want to make sure that you get some of both of those things with your card. You deserve to be rewarded for the shopping and spending that you already do.