Credit Scores & Credit Reports- How All Three of Your FICO Credit Scores are Calculated

Three Credit Scores: The Myth, The Real Number & More

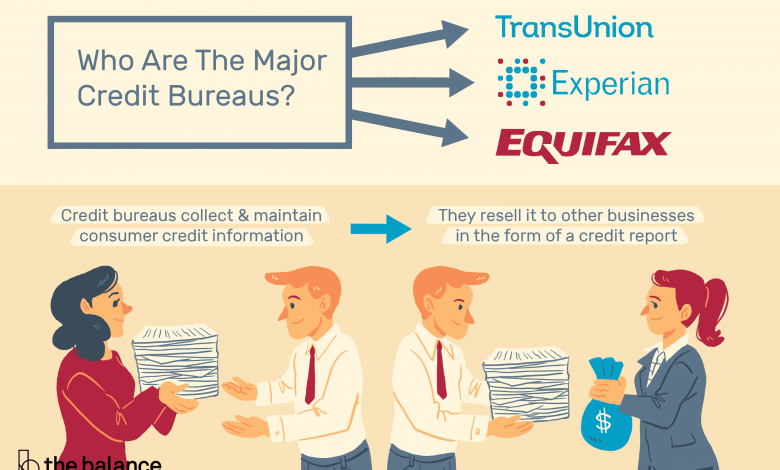

The three digit number on your FICO score has a huge impact on your life. It is important for you to understand how this score affects you so that you pay more attention to improving your score. Here are 10 things you need to know about your score and ways you can build and improve your rating. The three main credit bureaus are Equifax, TransUnion, and Experian. Each of these will issue a report. The reports issued include your payment histories and schedules. Under Federal law, you are supposed to receive a report at least once every year. Your credit report is very similar to your school academic score. It is the track record of your payment history and certain other things. These other things include but not limited to the number of credits, length of credits and so on. It is the measure of your success in relative to others and used by creditors to find out whether or not you are a credit-worthy customer.

Your Credit Score Affects Your Ability to Obtain Loans

Lenders and banks mainly consider your score before approving your request for a loan. This applies whether you are applying for a home, car or a loan for personal use. Your score determines your interest rates and lenders consider your score when determining interest rates. Borrowers with less than a perfect score are forced to settle for higher interest rates. This is due to the risk factor that the lender assumes. A good score can save you lots of money since you will get the lowest interest rates in the market.

Your FICO Rating can Affect Your Ability to Obtain Insurance

A good score increases your chances of getting a good rate on your car insurance. In some cases, you may be denied insurance due to a bad score. While your score is not the only factor used to determine insurance premiums, it plays a significant role.

FICO scores are determined based on the following factors:

- 35% payment history

- 30% amounts owed

- 15% is determined by your history.

- 10% is determined by the types of credit used.

- 10% new loans applications and other forms of financial cards

It is Your Responsibility to Get FICO Errors Corrected

The reports from the bureaus may have errors. These errors can affect your credit score. It is, therefore, your responsibility to obtain these reports and check for any errors. Ensure that these errors are fixed before you apply for loans. Your score can affect your job application or your ability to get a house or apartment. In most cases, employers and landlords will request that you furnish them with details of your score. In other instances, the employer and landlord may check your score without your permission.

Your FICO Score is Not Cast in Stone

According to a study by the Federal Reserve, people who are closely matched in terms of FICO scores are more likely to remain together for longer. Today, many people are considering scores before getting into committed relationships. Checking your score does not affect your rating and Requesting for your report does not have a negative impact on your score.

- Clear your credit card balances and ensure that they remain low

- Pay your bills in good time

- Maintain good history accounts

- Only apply for loans when you need them

- Do comparison shopping when searching for loans and other facilities

- Correct errors on your reports immediately

- Negotiate with creditors for flexible repayment schedules

- Avoid making many loan inquiries in a short span of time

- Keep your limits low

- Live within your means

Who Else Looks At My Credit Score

It is not just the lenders that use your credit score as a measurement before loaning you the agreed upon amount. More and more individuals, businesses and firms are using them, such as private banks, insurance firms, employers and landlords. For landlords and employers, this will help them figure out how responsible you are with money. FICO score, the most widely used credit scoring technique is a scale ranging from 300 to 850. The more your score is, the better. Anything over 740 will put you in the excellent list. A score below 650 will make the lenders look away. These are general facts about FICO score. You will get better rates, more credit lines, and special treatment if your score is excellent. Not so much if your score is poor. A slight difference in the score can make a huge impact on the outcome. For example, with a score of 750, your 30-year mortgage rate could be 4.3% while a score of 699 will fetch a 5.3% rate. That is about tens of thousands of dollars in savings over the life of the loan.

Facts About FICO Score

FICO score is calculated based on multiple criteria, the real formula of which is still a secret. Yet, some things are surely taken into consideration during this calculation. For instance, the automatic tool looks into your payment history which contributes to about 35% of the total score. The rest of the contributions come from the amount you owe (30%), length of the credit (15%), number of credit (10%) and types of credit (10%). Whatever magic number this tool comes up with will decide your financial fate for the future.

Stay Positive

Remember that a positive credit score is one of the biggest factors in your financial well-being, and only you have the power to raise that score. The most important element in determining your score is how you have paid your bills over the years, whether they were before the due date, on time or if you made delays consistently. The second important element is the amount you owe, which is not so straight-forward in the calculation. Here, the tool looks at how much of your available credit have you utilized. For lenders who look at your FICO scores, this will tell whether you are maxing out your credit which means it’s more likely that you will miss payments. The third element to consider is the average age of your accounts. The more the age, the better.

Less Is More

Additionally, how often have you opened new accounts? Opening a lot of credit card accounts will hurt your score. Lenders want to see a mixed range of credits as well. They are more leaning towards customers with different types of credit such as car loan, student loan, mortgage and business loan. They will also look at how responsible you were with each of these credits.

Advice On Improving Your FICO Score

With that in mind, here is some advice on improving your FICO score. It is not a Herculean task if you are paying attention. If not, you may be making more damage to your already sinking score. So, before we proceed, note that a low credit score is not the end of the world. You can start everything from scratch and lift your way up to financial success. And only time and patience can help you with your score. Now, getting those errors off your record is the first big step towards this success as well as the best advice on improving your FICO score. Once you notice any error, notify the bureau immediately. This may result in a significant boost of your final score. After you have done this task, try to change your spending habits here and there. It is worth the effort looking at the long-term consequences of a credit score. Any score below 700 should be a reason to worry about.

Stay On Top Of Payments

Keep track of your FICO score and help it improve is to be vigilant about due dates. Set your alarm, write down the date, use your reminder app – do whatever it takes to pay those bills on time. You will be glad you did because multiple missed payments will surely sink your score as mentioned above. Again, ensure that you are following the “utilization ratio” religiously. The rule of thumb here is to use 30% of your credit limit. Any amount lower than that is even better and will improve your score eventually.

Prioritizes Your Credit Debt

If you are confused about whether to pay off your student loan debt or credit card debt first, look no further. Credit card debt pays off is the way to go. Even if there is not much difference in terms of interest rate, paying off your credit debt will ensure that your FICO score will remain the same or increase. Besides, you need this score for future credits. Not sure how long you want to keep that card you never got to use more than twice? Wondering if you need to toss old cards from two decades ago? The best way to handle these situations is to do nothing and just let the account stay open. Your oldest card is the proof for lenders who look at the FICO scores that you have been responsible with it for very long. Remember, more than 10% of your score depends on the age of your card. What if you are not eligible for a regular card? No need to worry; you can always start with a secured card – the one that is backed by the money from your checking or savings account.

In Conclusion

As mentioned earlier, your score can get a huge boost if you are applying for different types of credits – car loan, mortgage and much else. However, you don’t have to apply for a mortgage just for the sake of increasing your credit score. Similarly, if you are not a student, the student loan will not be of much use. Creditors who look at your FICO scores do not expect you to take unnecessary risks as well.