Maximize Cash Back Rewards With a Cash Back Credit Card

Strategies To Maximize Your Credit Card Rewards

A cash back credit card can be an effective tool in helping you to manage your finances. In many cases, credit card companies offer rewards like cash back on all purchases for new cardholders. Cash rewards credit card issuers are wide in variety for how much cash back they offer, for example, up to 1%-6% or more, cash back when you make purchases from certain retailers or when you make your payment. Keep in mind that getting the most out of a cash reward credit card depends on what card you are using and having more than one cash back credit card is smart because you can decide which card is going to give you the most cash back when you are making your purchase.

The Positive Aspects Of Cash Back Award Cards.

There seems to be nothing better than earning cash by just spending; conceptually speaking. One makes a purchase, for example, on what cash back reward cards there are, and are instantly rewarded with savings following their purchases. The math is already done in most cases and the rewards themselves can even be tracked on the card holder’s app on a device.

Cash Back Cards can Generate Lots of Extra Income

If you have a cash back credit card, you will get a certain percentage of a qualifying purchase put into a balance separate from your credit balance. You generally have access to that money from the second that you earn it, and it may be used to make your monthly payment or to make purchases online. It’s easy to accumulate a large amount of cash over time when frequently spending with your cash back credit card and some cash back cards will have an option for you that allows you to donate your cashback balance to a charity.

How Much Cash Can You Get?

The amount of cash that you may be able to receive depends on what a specific creditor is willing to pay. Most allow you to get 1% back on all purchases with increasing amounts for certain categories like gas or groceries. During the holidays, you may be able to get up to 5% or more back depending on where you shop or what days you make your purchases.

Does Your Cash Expire?

Typically, when you receive cash back, the money stays in your account as long as it is open. In some cases, the cash may remain available to you even after you have closed the account, and it can be accessed by asking for a direct deposit to your bank account or a paper check. You can talk directly with the company that services your card to find out the exact terms of their program. In most cases, you will receive cash back almost as soon as you earn it. Typically, this happens after the purchase is confirmed and is applied to your account. From there, you can choose to either apply it to your credit balance or have it sent to your bank account as a direct deposit. Direct deposits are generally available several hours or days after the request is made.

Before Applying For A Cash Rewards Credit Card

When you apply for a card, you should first do a search for those that offer cash rewards as a perk. Almost every major credit card company offers one, and most applicants who have good to excellent credit will qualify. Once you have found a card that you like, you can start the application process online or send in a paper application.

What’s The Difference Between Cash and Points?

You may have seen advertisements for cards that offer rewards points or airline miles. In some cases, you may be able to buy points with cash or earn points each time that you make a purchase. Your points may even be redeemable for cash. However, the number of points that you have may not equal the amount of money that you receive by redeeming them. In other words, 1000 points may only equal $1 whereas a cash back balance of $10 is going to be worth $10. There are few better feelings in life than getting paid to shop or getting a bonus just for making a payment on your card balance. With a cash back credit card, you can save money on some or all of the things that you buy on a regular basis, which makes it easier to keep your spending in check. Since cash rewards may be used to pay down your balance, it may help keep your debt in check as well.

Core Cards

This type of reward system would seem far superior to the others; most notably the points rewards and the opening reward cards (some of these products are known as Core, for example) that offer an initial 0% APR that may run from 12-15 months depending on the financial institution. The Core cards are primarily targeted towards new applicants attempting to establish credit in most cases and have a lot of initial balance transfer attractions before the APR finally hits after the offer period, which is based on credit score. For some, this can be true sticker shock.

What These Cards Are Usually Used For

In terms of the Points Reward programs that are offered by various companies, these appear to be targeted to those that purchase items on a consistent basis mostly for hobbies, collectible items, gadgets, and apparel to name but a few keen interests. This is where the accumulation of points become rather a game of sorts overtime and the cardholder can eventually cash these things for gift cards or cash cards in a feeling of award and satisfaction for earning all those points over time.

Best Suited For the Working Professional

Cash-back rewards cards seem to fit perfectly for those not interested in the other aforementioned products. The cash-back rewards lineup seem to be most suitable for working professionals and for that on-the-go that really have no time to tally and calculate what they are getting points with purchases altogether, nor simply applying for a new credit card for that matter. Some companies that are partnered with the credit card and lender are known to provide up towards 4% cash back for every $1 spent at that particular business.

What Cashback Reward Cards Are There?

There are a variety of cash-back reward cards on the market currently as there are financial institutions out there offering them. Some have very low APR for new customers after the initial offer period and the choosers must base decisions on these cards with specific shopping patterns; for they reward the best percentages to those places a consumer will frequent the most; such as certain gas stations, restaurants, and grocery stores that partner with the bank or financial institutions in many examples. Then there are others that have a well rounded and cash-back reward percentile that is consistent no matter where a shopper frequents throughout the year, but their APR may not be as attractive in other cases for some applicants who don’t have such a stellar credit report per the bureaus working with the lenders in these scenarios.

What Is The Process For Signing Up These Cards?

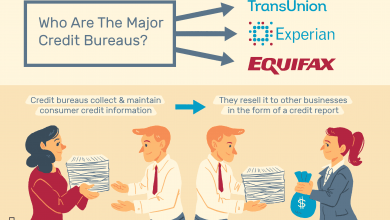

Signing up for these cards more than likely requires a typical credit check because you will obviously be borrowing a line of credit. After submitting the application; whether with a representative at the office, over the phone or even on the internet, they can sometimes provide a quick response depending upon the bank’s relationship with the credit bureaus along with their systems they utilize for the initial screening. If the APR winds up not suitable for the applicant after the initial offer terms, for example, there are other options out there for someone seeking a cash-reward product, such as credit establishment lines to help improve your credit.

Credit Lines

Credit lines are also established and even provided following a submitted application. Many institutions can provide other options should the consumer not agree initially with the opening line of credit they wish to have on a card. The applicant can also contact the credit bureaus establishing these credit lines and APR to question or even dispute the information that returns. Ultimately, it seems that the cash-back rewards program is the most viable and attractive of the current products on the market at the present time no matter what the situation is regarding an applicant’s credit standing at the time of applying The lenders are eager to have new consumers brought onboard as much as the applicants are keen on borrowing at the same time. The economy is considered very healthy at the present; consumers are returning to the market at a vigorous rate not seen since the Great Recession of 2008. While rebuilding perhaps a lost credit standing they once had before that difficult moment in history, they are also rebuilding many aspects of their home, maybe their vehicles and ultimately their livelihood.

After Natural Disasters

For a majority of those that have gone through these unfortunate situations with the natural disasters of recent times within the Hurricane ravaged Atlantic Coast and the Gulf Of Mexico regions in the last few years, attaining a viable credit line that also helps you save while making these urgent repairs and purchases seems to be the most optimal choice. The cash-back rewards card appears to be the ideal answer to help repair many in these recent straights as they re-enter the workforce and begin to reestablish what was once lost during those tragic times. To have to chase “points” or deal with a limited offer for a low APR until the offer itself ends does not seem advantageous whatsoever considering the bigger picture. In that case, it would then seem that the simple accrual of cash for necessary purchases that it is automatically provided by most of the Cash Back Award cards, be the most logical choice truly ideal avenue to follow for those that need the time and savings to simply rebuild. For others, they can go about making their day-to-day purchases and realize that in the long run, they are in effect, saving money and even building income along the way.

Better Together

Again, this is a perfect marriage for both the lenders and the consumers, as it piggy-backs on a strong and viable economic situation the United States is currently having the fortune of experiencing. If there are any possible snags due to the present bullish market, it would be that the financial companies can be stringent regarding their initial screening processes; whereas the need for new borrowers was much more desperate perhaps during the times of the Great Recession in contrast. On the other hand, if the bank offering the credit cards is doing well, they can provide more attractive offers to a variety of applications than in a Bear Market situation; as it always has been the case since the concept of borrowing then establishing credit lines and cards since the 1950s; or loans themselves that were once lent out by what were considered proto-banks going back to the days of ancient Assyria and Babylonia about 4,000 or so years ago.