How Much Does Credit Score Affect Auto Insurance Rates?

How A Credit Score Affect Your Car Insurance Rates!

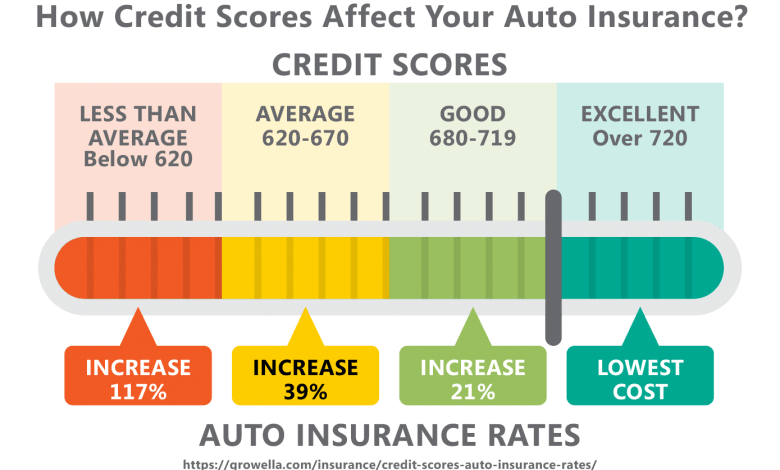

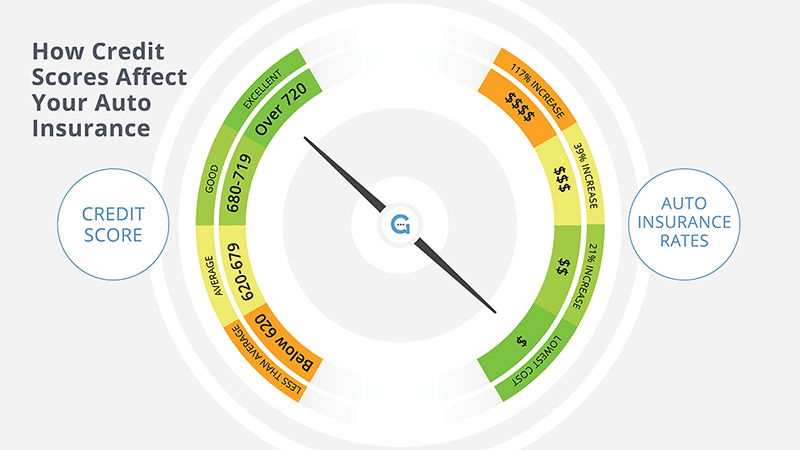

There is a little-known fact about our insurance premiums and our credit scores. Depending on our credit score, this number plays a factor in how much we pay for car premiums. Out of the U.S. fifty states, only 5 states (Georgia, Maryland, Hawaii, Utah, Oregon) do not comply with using credit history as a basis for raising or lowering insurance rates. We would also like to ask what companies offer insurance based on credit scores, could I lower my car insurance if I raise my credit scores, or what companies can offer low insurance if I have bad credit?

What Insurance Companies Look For

The reason that the insurance industry scours the credit history of their clients, seems to at least make sense to them. The insurance agency’s justification for using credit scores is that they believe that low credit scores are an indication of future insurance claims. No, credit scores within the insurance industry have nothing to do with how well you drive, the fact that you have never gotten a driving ticket, or that you have never filed a claim. The insurance industry believes that the higher your credit score is, then the less likely you are to file auto claims. Instead, follow the money! The industry believes that if you have a good credit-based insurance score, then these clients are least likely to file fewer expensive claims. The larger denominator for increased insurance rates is your credit score.

Car Insurance Rate Risk Factors

Do you have a clean driving record? Drivers who involved in recent crashes generally must pay more than those who have been crash-free for several years. As time goes by, the effect of past crashes on your premiums will decrease. What kind of vehicle do you drive? Most insurance companies have lower rates for customers who drive safer vehicles. The opposite is true for people who buy cars that are engineered to go fast. How often, and how far, do you drive? People who drive more frequently and for greater distances can expect to pay more for their insurance. The more time you spend in your car the more likely you are to be involved in a crash. Where do you live? Generally, city dwellers will pay higher rates than country folks due to the greater chance their vehicle will be vandalized, stolen or involved in a fender-bender. What’s your gender, marital status, and age? Generally, men pay more than women, singles more than marrieds and young people more than old.

Your Credit-Based Insurance Score

Here’s where it gets a little complicated. Insurance companies don’t directly use FICO scores to set rates. Instead, they purchase your report from a credit rating agency and selectively pull elements they believe are most relevant to your accident risk to calculate what’s known as a “credit-based insurance score.” The extent to which FICO credit scores are predictive of insurance company credit scores is unknown. The insurance companies have no legal obligation to disclose the proprietary methods they use to calculate a score. As a result, you can’t rely only on your FICO credit score to reliably predict your “credit-based insurance score.” As always, you’ll need to shop around to be sure you’re getting the best price, especially if your credit history is spotty. Insurers have different ways of weighing risk factors. You’ll almost always find an insurance company that views your imperfect credit score as less of a problem than others.

Credit-Based Insurance Score

Just like a 3-digit credit history score, the insurance industry also uses a 3 digit number to calculate the information that they extract from your payment history. To the insurance companies, they use this number to determine the customer’s insurance risk now and in the future. Insurance carriers use the following parameters to give them each customer’s credit-based insurance score:

- Overall payment history

- How much we owe on all of our credit report accounts.

- Your credit utilization which shows how much debt you have presently vs. how much you use

- How many new credit applications have the customer requested during the year known as “new credit”

- The types of credit you carry, like loans, mortgages, credit cards

Don’t worry, there is no other personal information gleaned from your credit history. Simply put, our credit report score is quite different from a credit-based insurance score. A credit score to lenders represents how likely a person is to pay back their debt and what their interest rate is. Insurance companies don’t see your face, when they look at you, you represent a risk – we all do. Many insurers operate under the principle that a customer’s credit history indicates their likelihood to file claims. In other words, insurers believe that a credit-based insurance score represents future claims that may or may not be filed.

What Companies Offer Insurance Based On Credit Scores?

Because of transparency rules, the National Association of Insurance Commissioners reports that 90% of car insurance companies are using the credit score system to determine the premium rates assigned to customers. For example, naming what companies offer insurance based on credit scores includes leading insurance companies like the following that participate in checking credit scores vs. credit-based insurance rates – Allstate, Farmers, GEICO, Nationwide, Progressive, State Farm, and Travelers, just to name a few. This credit score checks vs. credit-based insurance practice are not new. Unbeknownst to the public, using customer credit scores to determine insurance premiums has been in practice for more than 20 years. For this reason, determining what companies offer insurance, based on credit scores, is such an open secret.

Demand The Truth

However, if caught red-handed and you ask your insurance company if they use this practice to adjust your premiums, they must confess! Granted, they do not have to tell you what your credit-based insurance score is, but they must reveal their use of your FICO credit score. A customer’s credit score is not the only factor used by the insurance industry to determine auto insurance premiums. Insurance carriers also look at the type of car you drive, driving record, and financial history. However, an interesting additional factor on your credit report that is looked at by insurers during their underwriting process is the length of your credit history. It seems that the more information you have on your credit history and if you have managed it correctly, the better risk you are. Below are 5 key factors that are used in identifying how a credit score affects your car insurance rates:

- Outstanding debt

- Payment history

- Late payment history

- Total past due amounts

- Bankruptcies and or collections that are considered bad credit

Lowering Car Insurance

Speaking of bankruptcies or bad credit, could I lower my car insurance if I raise my credit scores or what companies can offer low insurance if I have bad credit? There is one thing about car insurance that makes it flexible, it is not a fixed rate. With time, improving your on-time payment history, and make timely payments on unsecured or secured credit cards, you can answer the question of could I lower my car insurance if I raise my credit scores. With your credit history, do everything you can to improve your credit score because we have just learned that insurers are monitoring our history. The simple response is yes to the question, could I lower my car insurance if I raise my credit scores? Additionally, if you increase your deductible, insurance carriers consider this a win-win on your record. According to the Insurance Information Institute, they believe that you should reduce your collision and comprehensive coverage to help save on insurance rates.

What Companies Can Offer Low Insurance If I Have Bad Credit?

Even with bad credit, consumers can still get car insurance coverage to protect themselves and others on the road. Please conduct some research on auto insurers, looking for different discount offerings. Look for bundling discounts, discounts for being a safe driver, paperless discounts, student discounts, low-mileage discounts, organization-based discounts, safety driving course discounts, and also try negotiating. The leading auto insurers named above addresses the query of what companies offer low insurance if I have bad credit or who have gone through bankruptcy.

Your FICO Credit Score

FICO credit scores are a numerical panacea source that is viewed by other providers of services, like car dealerships, banks, utility companies, cell phone services, realtors, and certain employers, etc. Credit scores to industries like insurance is a template of how you value your money spending habits and how you will manage your financial future. Please watch your spending habits and remember to ask yourself when shopping if this is a want or a need!