Options For Refinancing Your Home With Bad Credit

Best Refinance Lenders - All Credit Scores Are Welcome

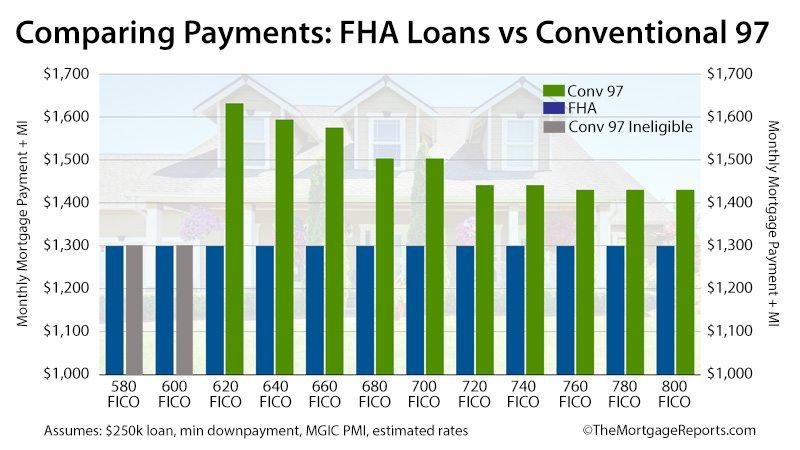

It’s true that having bad credit can make finding home refinancing options difficult but that doesn’t mean you can’t still qualify for a lower rate on home refinancing because of negligent credit history. In fact, you may still qualify for refinancing even if you have had to file for bankruptcy or you have collections accounts on your credit file. FHA loans are popular with first-time borrowers and homeowners who have less-than-perfect credit or need a low down payment. If you have an FHA loan for your house, you may qualify for the FHA Streamline Refinance, a program that simplifies the refinance process with less paperwork and reduced credit requirements. The FHA Streamline Refinance program eliminates employment and income verification and there is usually no minimum credit score to qualify. Most homeowners do not even need an appraisal. To qualify, your mortgage must be current and you must get a “net tangible benefit,” which means the refinance will reduce your interest rate for a lower monthly payment.

Qualify for a Government Refinance Program

There are a couple of government programs available to help homeowners with bad credit to reduce their monthly mortgage payments. With HARP, you can get your mortgage payments lowered to a minimum of 31% of your gross monthly income if your lender participates in the program. Another common option is the HARP, which helps homeowners who owe more than their house is worth. There are no credit score or house value requirements for HARP, but your loan must be owned by Freddie Mac or Fannie Mae and not be an FHA mortgage. You must have some source of income and be current on your mortgage. You must also benefit from the refinance with a reduction in your monthly payment or another type of tangible benefit. One of the most underutilized options that many homeowners are not aware exists is called recasting. Recasting a loan does not require a credit check and it allows you to reset the principal loan amount with a one-time payment. Also called re-amortization, recasting can help you reduce your monthly payments, even though it won’t change your interest rate.

- In most cases, you will need at least $5,000 to recast your mortgage.

- Are self-employed or have bad credit, which can make it difficult to qualify for a refinance loan

- You recently refinanced and you do not want the additional cost

- You received an inheritance, large tax refund, or another source of money

- You want lower monthly payments to protect you against financial hardship in the future

Recasting usually has a low one-time fee of around $250. After you pay the lump sum toward your mortgage, ask your lender to amortize the remaining balance and update your monthly payments rather than simply reducing your principal.

You can still get an FHA to refinance loan if you do not currently have an FHA loan. To qualify, you will need to go through a credit check but you can qualify with any credit score as long as you have sufficient equity in your home. The program requires at least 2.5% equity, but a credit score below 580 boosts this requirement to 10% or more. You cannot have a recent bankruptcy or late mortgage payment on your record and your debt-to-income ratio must be lower than 43%. This option will refinance you into the FHA program and the mortgage premiums that come with it.

VA Interest Rate Reduction Refinance Loan (IRRRL)

If you have a VA loan, home refinancing is extremely easy. The IRRRL program requires that you have a VA mortgage, are not taking out cash from the loan, and are either refinancing from an adjustable rate to a fixed-rate loan or lowering your interest rate. You don’t even need to be living in the home to qualify and no credit check is required.

Reasons Why Refinancing A Home Is Beneficial

There are numerous reasons why individual or homeowner would consider to refinance their home. Sometimes homeowners just want to lower interest rate. Other times a homeowner may want to shorten the length of their mortgage contract or they may want to change the terms of their contract from a variable rate to a fixed rate. Refinancing the home could also give the homeowner more money for larger purchases because of them borrow against the equity within the home. Whatever the reason for the refinancing homeowners must be sure that their sole purpose for re-financing is going to be the best choice.

Reason To Refinance

When homeowners are thinking about should I refinance my home the next immediate thought should be the reason why they want to refinance their home? It does not make sense to refinance the home just to be doing it. There must be a definitive reason behind the consideration. For example refinancing a home to lower the interest rates can save the homeowner more money over the life of the loan or if a homeowner refinances their home to borrow money against the equity within their home for a larger purchase like for a business, then they know that there is going to be additional revenue coming from that business to pay off the loan from the refinancing that was done on the home.

Additional Things That A Homeowner Can Do To Improve Their Chances Of Obtaining Refinancing

Because refinancing the home was not completely black and white customers have to think outside the box when it comes to improving the odds of obtaining a refinancing loan off of their home. Even though a customer may have bad credit that does not completely Wipeout their chances of obtaining refinancing. When homeowners are seeking out to know what companies offer refinancing if I have bad credit they should keep in mind that their selection will be limited due to their poor credit. So one thing they can do is to show the lender that they are responsible for making their payments on time. If a homeowner is able to highlight positive qualities and can present additional documents that show their payment track record of making payments consistently and on time then that will be a big help to the lender when making their overall determination.

Would Refinancing Raise Or Lower My Credit Score

The primary reason for homeowners posing this question to the lender is because the lender needs to be able to break down the pros and cons of the refinancing to the homeowner. No homeowner is going to want to take on a refinance of their home mortgage and then end up being in a worse state than they were before they did the refinancing. Granted that has happened in the past when homeowners were lied to about the good and bad aspects of an agreement. But that is all the more reason why it is important to ask as many questions as possible as well as research the company too.

Show That You Have Savings

Most lenders that are offering to refinance for homes want to see that if they approve homeowners for a loan based upon the equity from the home, that the homeowner would be able to repay the loan. Showing a savings account proves that the homeowner is able to manage their money efficiently and yet still have the means to live. It also shows the homeowner has the ability to continue to make their payment even if they have an emergency.

Do I Need a Cosigner On The Account

If the homeowner has to apply for the refinancing with a cosigner, then that cosigner should have better credit and be more financially stable than the homeowner that is applying for the loan. Any bank, governmental program or private lender would be more app to approve the loan request knowing that a borrower has added means to repay. If a co-signer has better credit but is not financially stable or vice versa, then that would not help the homeowner in being approved for the refinancing loan. The co-signer must have both financial stability and good credit.

Streamline Their Refinancing

If the homeowner’s original loan was through the Federal Housing Authority then they should be able to streamline their refinancing process. This type of refinancing allows the homeowner to save more time and money by shortening the process and the paperwork of the refinancing request. It also eliminates the need for the homeowners home to be appraised.

Ho

Conclusion

As previously mentioned when it comes to should I refinance my home, would refinancing my home improve my credit, would refinancing my home damage my credit or what companies offer to refinance if I have bad credit questions, homeowners should make a list with these four questions listed at the top. Because when a homeowner is considering going through this process and after having posted these questions, if their responses to each question do not result in any real benefits then they should not do it. Refinancing a home has sometimes received poor or bad reviews but the underlying basis for refinancing of a home is actually a positive thing. It simply just boils down to homeowners being able to really pick apart all the paperwork that is included when it comes to refinancing a home. Homeowners need to have a thorough and detailed understanding of the process, the paperwork itself and the outcome that is going to result from doing the refinancing of their home. It all has to make sense because if it does not then they should not do it.