Your First Credit Card – What You Should Know Before Choosing Your First Credit Card

Before applying for a credit card you must first decide what type of credit card you need because there are many different kinds of credit cards, for example, cash back credit cards.

Figuring out how credit cards work and which type you are going to choose and how to go about getting them can seem overwhelming, but once you have the facts, it’s not all that complicated to apply for a credit card. Some of the quickest and easiest ways of applying a credit card can all be done online in a matter of minutes.

How Does A Credit Card Work?

With credit cards, you can make purchases with money borrowed from a bank. You can either pay the money back in full within the “grace period”, which is usually 30 days, or you can make smaller payments each month until it is paid off. If you decide to make smaller monthly payments, you will also pay an additional amount of money, called “interest”, with every payment. Different cards will have different interest amounts you’ll pay. Credit cards are a great way to build your credit history up and when you have a high credit score you can apply for personal loans and home loans and get lower interest rates than the average.

How Do You Choose Which Card to Get?

First, you will need to decide what you need. If you don’t plan on paying off the balance completely every month, look for a card with a low-interest rate and no annual fees. You may also want to look at when bills are due each month. Check out reviews online for the credit card to see what other people say about it. Some cards also provide rewards when you pay off the balance each month, so if this is your plan, look for a card with rewards that would benefit you personally. When you receive your first card, be responsible. Remember that your financial history will follow you. If you max out credit cards or fail to make payments, you can do major damage to your credit history. A bad credit score can make it difficult to make purchases (like cars and homes) in the future. Do your research and find what works best for you and your future.

How Do You Receive One?

You will need to complete an application by providing a certain amount of personal information. Different cards will require different information: most likely your name, your contact information, plus additional information. Some cards will ask you to verify employment, especially if this is your first one. You may even be denied your first time; that’s not uncommon, and you can try for a different card. If this is your first card and you’re unemployed, you will have to have someone co-sign for the card. That means that the other person will become financially responsible for the debt if you fail to make payments.

Ways You can Apply for a Credit Card

- Online – fastest and most secure

- In person at a bank – effective

- Through regular mail – slowest

- At a retail store – Guaranteed

If you don’t have a bank account or steady employment, there are other ways to get credit cards, for example, a store credit card. If you’re a young adult, there are starter credit cards you can apply for. Make sure you check their interest rates, as they might be quite high. You could apply for a credit card at a retail or department store and save money when you spend at that particular store. They have higher interest rates as well, but being approved is much easier. If you are responsible with one of these cards, you can build your credit and be able to get one from a bank later on.

Obtaining A Credit Card For The First Time

There are milestone moments in a person’s life such as when they graduate high school, get married, have their first child. There are even some moments that we may conventionally think of as being milestones, but they still are. A great example of this is when a person obtains their first credit card. The fact is, when a person joins the club of those who carry credit cards, they begin to develop a credit score. That number is highly important to them, and it can determine if they will be able to borrow money into the future.

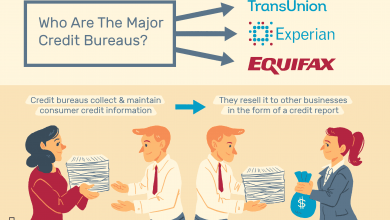

Facts About Credit Cards In General

It turns out that about seven in ten Americans have credit cards of some type as part of their financial life. That is a huge number in comparison to the number of people that had them when they first came out. You see, credit cards were not always the essential part of one’s financial life that we think of them as being today. There was a period of time when these cards were something that was offered but that few people took advantage of. That is no longer the case. Credit cards are meant to be used for everyday purchases, but that they should be paid off in full if possible each month. Not carrying a balance on the card means that the holder never pays any interest on that card. Unfortunately for many, they end up carrying a balance and paying interest. That is all a matter of personal behavior and control. Different credit cards offer different rewards to those who hold them in many cases. You may not get all of the extra rewards that those more experienced with credit might get, but you can at least get started in this way.

What Do Credit Companies Offer Credit Cards If You Never Had One Before?

Everyone wants to know what the easiest way to go from having no credit cards at all to finally getting one in their hands. There is no magic formula to this, but there are some ways in which you may be able to improve your odds. You can start by applying for a credit card with the bank that you already use for your checking and savings account. Do you need a debit about to have a credit card? Well, facts about credit cards, in general, will tell you that you don’t necessarily need to have a debit card to have a credit card, but having a debit card just means that you have an account that you can make electronic debits transactions from. In other words, you have a bank account that you are drawing from. That is probably a good first step if you are considering getting a credit card in the first place. When it comes to what credit companies offer credit cards if you never had one before, you may have to go with an off brand name to get your card. There are some companies out there that you may not have heard of before that may be willing to offer you a card. It is not the worst thing in the world to accept this offer, you just need to make sure that in doing so that you actually look at reviews of the company beforehand to make sure they are legitimate in what they have to offer.

Making The Strongest Case For Yourself?

Proof of income is one of the strongest ways that you can make the case for yourself getting a credit card if you do not already have one. You may wonder, “do you need a debit about to have a credit card?”, but the more important thing is that you have an income so as to have a way to pay back the money that you borrow. The most vital thing that the credit card companies care about is getting their credit back when they lend it out to you. It is difficult for them to chase down those who do not have the ability to pay back the money they have borrowed. Credit card companies will do this if they absolutely must, but they would prefer that you just paid back what you borrowed on time. Thus, the proof of income can help take away some of the stress that they may have about lending to you in the first place. When you go to apply for your first credit card, you might want to go for one that has a low credit limit. That is the kind of card that is more likely to be lent to someone who has no credit history. This is because the credit card companies know that if they lend less to someone, at least they don’t have the risk of losing a lot of money to that person.

What You Should Do When Your Card Arrives

When you receive your credit card, you should activate it right off the bat. You want to get the most out of the card that you have obtained, and that means putting it right to use. You should also read the fine print related to your card and check into the rewards that are available on your card. You might find some surprises there. You can open up an online account related to your card in order to make it easier to view your balance and make payments. Most people do this in order to make sure they can make their payments in the easiest ways possible. It is certainly a lot better than mailing in a check or making a payment by phone each month.

Final Takeaways

You should be able to answer the question “do you need a debit account to have a credit card?”. You should also understand what your interest rate is on your card and what kind of cards are appropriate for a first-time applicant. You should know that you need to get as much from your credit card rewards as possible. All of these things are important to the average cardholder, and they matter even more so to the first time applicant. Keep all of these facts in mind when you think about getting your first card