Barclaycard Mastercard Credit Card Offers – Arrival Plus or No-Fee Version Compared

Barclaycard Rewards MasterCard® Reviews

Barclaycard offers a huge variety of credit cards for users. They currently offer nineteen cards according to their site, so there are definitely a few from which to pick. The Barclaycard Arrival Plus World Elite Mastercard and the Barclaycard Visa no-fee version stand out though and deserve to be compared. Which card should you choose? The Barclaycard Arrival Plus is a credit card with a double-edged sword. On the one hand, its relatively high-interest rate can make it burdening for some users. However, if you have sufficient self-discipline, there are many benefits that come with this particular credit card. The standard fee of $89 per year is somewhat small, but if you are on a very tight budget this probably isn’t for you. Still, I will endeavor to show you that the money is well worth it. Let’s examine the facts about these cards.

Barclaycard Arrival Plus World Elite Mastercard

This card offers some serious benefits for the $89 dollars per year annual fee, which is not charged for the first year by the way. It offers great rewards for people who are constantly on the go. For example, the World Elite Mastercard offers 40,000 bonus miles, equivalent to $400 on statement credit, related to traveling of course, if you spend $3,000 in the first three months of owning the card. It seems that it wouldn’t be very difficult to reach that amount given the cost of travel.

Miles

Let’s talk about the numerous benefits. Whenever you make a purchase with this card, you will automatically obtain “miles” that can be redeemed in a number of ways. The term “miles” can be a bit misleading here, as it would imply some kind of free travel. However, the miles that you accrue with this card are just points that can be redeemed for other benefits. If you want to keep it simple, you can just redeem the miles for cash. In a way, you can get free travel because you can get discounts on various travel expenses including travel packages, airline travel, hotels, and resorts.

For Example

If you spend at least $25,000 a year with your Barclaycard Arrival Plus card, that will translate into 75,000 miles. After this threshold is reached, you will begin earning double miles on all your purchases for the remainder of the year. If you are the kind of person who racks up a lot of purchases on your card, this can be a very good arrangement for you. Best of all, there is no upper limit to your miles, which means that you can save them up without fear of losing them. There is no pressure to use them.

No Foreign Transaction Fees

As this card is intended for the frequent traveler, it should come as no surprise that this card has absolutely no foreign transaction fees, or that it has an international chip that can be used at terminals all over the planet.

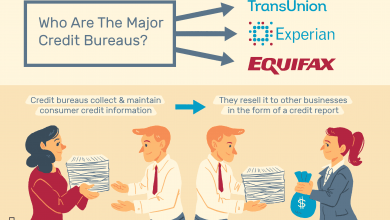

It Gives You Access To Your FICO Score

Allowing you to keep an eye on your credit and makes sure everything is up to par. There are no foreign transaction fees charged while using this card, which can be a lifesaver for the person traveling to other countries often. Speaking of travel, sometimes places are not as secure as they should be. To that end, this card employs the EMV chip technology and also does not hold the user accountable for any reported unauthorized charges. So, with this card in hand, you can breathe easy knowing that you are protected.

Neat Travel Community

Barclaycard offers a very unique service where you can post stories about trips you have taken to their Barclaycard Travel Community where you can earn miles just for writing a story and posting it! This company goes even further and, when using this card, it offers insurance on accidents as well as the trip cancellation for approved reasons. One of the most useful aspects though is the concierge service, which goes above and beyond what a credit card company should ever have to do. Barclaycard cares though, and it is evident in this complimentary service available every day and night. Lastly, this card has a very enticing balance transfer offer.

Reward Points

There are also everyday benefits to this card including two points for every $1 you spend at restaurants. Let’s face it, for whom wouldn’t that be beneficial? You also get one point for every $1 spent on everything else for which you use your card. Once again, users are not going to need to worry about any reported unauthorized charges on their credit card, which is a huge relief. Last but not least, this Barclaycard offers assistance worldwide with cards that are lost or stolen, allowing you to seek help at any time of the day or night.

So Which Card Should You Pick?

Both of these cards are incredible and offer great rewards for their users. The Barclaycard Arrival Plus World Elite does seem to edge out the Visa a bit due to the overwhelming amount of rewards and benefits offered to its users. However, a lot has to do with what you are going to do with it. If you are a huge fan of Apple and don’t travel very often, the Barclaycard Visa is a great way to go.

Financial Discipline

And I would like to mention a word about financial discipline. There can be fewer mistakes in the world that are more damaging than an inability to control one’s spending habits. Before you know it, you can find yourself in a position where you cannot pay your bills, simply because you could not resist those tempting impulse purchases. If you are the kind of person who cannot resist the urge to buy everything you want, you really should not have a credit card in the first place. This is why I don’t consider the high-interest rate to be a huge drawback. What kind of credit do I need to get these cards? That is something that can and will vary.

The Barclaycard Visa with Apple Rewards

This no-fee card has its fair share of rewards to offer as well. For the Apple product connoisseur, this card is the way to go. It offers a variety of financing options specifically for Apple products, allowing users to purchase these products over time with a less upfront cost. The financing time frames include six, twelve, eighteen, and twenty-four months, depending upon the cost of the item. You can also earn three points for every $1 you spend buying Apple products. This is definitely not bad considering the fact that Apple products are not known to be inexpensive. Plus, every time you earn 2,500 points, you will receive a gift card in the amount of $25 to be used at either the iTunes Store or the Apple Store.

The Barclaycard Visa with Apple rewards

This card is offered in partnership with Apple (yes, the same company that makes your phone and possibly your computer). As such, it offers many incentives that are related to Apple products. As stated earlier, this card has no annual fee, so you’ll save $89 right there. You won’t get all those nifty travel perks, but you can still accumulate points when you make a purchase with the card. As before, the points can be redeemed for a variety of rewards. You will be limited to gift cards in this case. You can choose to either receive a gift card for the Apple store, or the iTunes store.

When Purchasing Apple Products

This card also has some interesting ways to reduce your interest payments. On purchases from Apple that are less than $499, you will pay no interest whatsoever. The only catch is that you must pay the purchase in full within six months. The $499 threshold does not include tax or shipping. If the balance is not paid within six months, interest is assessed according to your credit rating. There is also a 12-month plan for purchases between $499 and $999, and an 18-month plan for purchases of $999 or greater. All three payment plans are basically the same apart from the payment threshold and time limits.

Unlike the Arrival Plus

The Apple Visa does charge certain fees for the transfer of funds, and for foreign transactions. However, this should not be a huge problem because the foreign transaction fee and the balance transfer fee are only 3%. these are just some important facts about these cards that you should know. What kind of credit do I need to get these cards? Well, that’s not an easy question. There is not a specific threshold, but many of the fees that are assessed when using these cards will vary depending on your credit score. Your interest rate will normally be 15.74%, 21.74% or 28.74%, so check your score before proceeding. When asking yourself “what kind of credit do I need to get these cards”, you should really be asking if your credit is good enough to take out a bank loan. If you can’t get a loan, your credit is probably inadequate.