The Best Credit Cards For Poor Credit That Rebuild or Establish Good Credit History

Credit Cards to Build Credit - Personalized Credit Card Deals

Having poor or no credit can be very difficult for a person. There are a variety of reasons why this might happen including coming of age to have a credit card, thus having no reason for a credit history. You may have experienced bankruptcy or have had a number of other events occur.

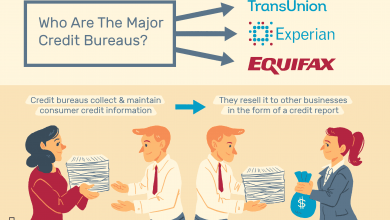

People suffering from low credit score often wonder what could help to rebuild credit history and what other cards are available for those with poor credit score. A low credit score is the last thing an individual wants in their credit history. A credit report directly affects the chances of getting an approval for a credit card or a loan.

How Do You End Up With A Low Credit Score

There are three major reasons for a low credit score such as rejection of a credit card application, defaulting on payment of bills and low income. Getting back on track with a high credit score from a low one can be time taking but very much possible. The first step in improving credit score is to clear out on pending bills and start paying future bills before the due date. But this initial step is not enough to get credit card approvals and loan sanctions at higher interest rates. It is a must to build a credible credit report overtime for the lenders and the banks to believe in your capability of repayment of loans and outstanding on credit cards.

The Truth About Rebuilding Credit

It is a myth that avoiding new credit cards with the fear of becoming a victim of the never-ending loop resulting in the lowering of financial burdens and increase in the credit score. It is strongly recommended to open a new account and responsibly use the credit card with timely payment of outstanding for building a good repayment history and consequently affecting the credit score positively. So for individuals looking out for what other cards are available for those with poor credit score, fortunately, have options in the market. Experts strongly suggest that the individuals refrain from applying for many credit cards, as every rejection leads to a drop in the credit score thus making it very hard for any approval at all. The process of rebuilding credit can seem challenging, but bad credit or no credit isn’t the end of the world. Let’s talk about the best credit cards for situations like these.

- The BankAmericard Secured Credit Card

- The USAA Secured Card American Express

- The Secured Mastercard from Capital One

The BankAmericard Secured Credit Card

The BankAmericard Secured Credit Card is a brilliant option for people with poor credit or no credit and can help with credit rebuilding. It requires collateral of $300 minimum, which could possibly be returned to you depending on several factors. Considering your income as well as debt and other aspects, your credit limit will be adjusted to the amount of deposit you put down on this card. Basically, this is a fantastic way to earn the trust of the card company and work to rebuild your score. This card is also helpful in that is offers you your FICO credit score so you can keep up to date with your credit building or rebuild. Plus, Bank of America offers educational materials to help you learn how to manage your credit effectively. This can be a lifesaver because the world of credit has a whole language that has to be learned in order to succeed.

Considering your income as well as debt and other aspects, your credit limit will be adjusted to the amount of deposit you put down on this card. Basically, this is a fantastic way to earn the trust of the card company and work to rebuild your score. This card is also helpful in that is offers you your FICO credit score so you can keep up to date with your credit building or rebuild. Plus, Bank of America offers educational materials to help you learn how to manage your credit effectively. This can be a lifesaver because the world of credit has a whole language that has to be learned in order to succeed.

The USAA Secured Card American Express

The USAA Secured Card American Express is a superb example of a card for an individual with bad credit or no credit. It also helps with the process of rebuilding credit.  Now, one of the great features of this account is that when you put down the deposit on your card of a minimum of $250, you will create a USAA Bank Certificate of Deposit effective for two years. This CD earns 0.54% APY, which is changeable. This is very unusual for a secured credit card because it allows you to earn interest on the money you have deposited for collateral on your card. Also, if you want to increase the limit of your card, you can request to do so after its initial start by adding money to your CD.

Now, one of the great features of this account is that when you put down the deposit on your card of a minimum of $250, you will create a USAA Bank Certificate of Deposit effective for two years. This CD earns 0.54% APY, which is changeable. This is very unusual for a secured credit card because it allows you to earn interest on the money you have deposited for collateral on your card. Also, if you want to increase the limit of your card, you can request to do so after its initial start by adding money to your CD.

So Where Is The Money?

The money isn’t just sitting there, but it is earning money too. Just like other secured cards, the amount you choose to deposit will also serve as your USAA Secured Card American Express’ credit limit. So, you have some choice as to how much money you want to have available to spend. This card also offers some great benefits including extending manufacturer warranties on items paid for with it. Plus, USAA offers identity theft assistance, which can be a lifesaver in this uncertain world. USAA also makes travel easier by charging no fees on foreign transactions as well as by offering rental car collision damage waiver coverage. It doesn’t hold you responsible when theft occurs of your card and unauthorized charges occur as well. This specific card offers some fantastic benefits to members of the military as well. It is extremely diverse and has so much to offer its owner.

The Secured Mastercard from Capital One

The Secured Mastercard from Capital One is a stellar example of a credit card for an individual with no credit who is building or who is attempting the process of credit rebuilding. It can be available to those with bad credit as well. This card requires a deposit of either $49, $99, or $200 depending upon the factors that make up your existing credit or lack thereof. Then, if you pay the minimum amount required for your deposit, your credit line will start at $200. However, if you want a higher credit line, all you have to do is put more money down prior to creating your account. It doesn’t get easier than this! Capital One rewards you for making payments on time too. If you do that for the first five months, Capital One will raise your credit line. So, the goal here is to make sure that you stay up to date with payments and the benefits will follow. Plus, it gives you access to your credit score at all times and provides you with the ability to watch your credit as it builds or rebuilds.

What To Expect When Rebuilding Credit

While searching for options, one can come across subprime credit cards meant for people with bad credit history and have very high rates of interest along with high annual fees which makes it non-feasible for individuals with a poor credit score. Then comes prepaid cards, that can be acquired irrespective of the credit history one holds. The reason for avoiding is that the lenders do not report to the credit bureaus hence timely payments and wise use of the prepaid card will not reflect on the credit score thus securing no result despite such efforts. It is important to understand that becoming impatient will get you in trouble. If rejected, one should wait for the communication from the bank stating the reasons for denial and making appropriate adjustments rather than blindly applying for credit cards thinking one day luck might click for them. The reason behind a rejection may be directly based on your income rather than the credit score.

Tips On Improving Your Credit

Bad spending habits are the only reason for an individual to be a victim of a low credit score. First and foremost a change in spending habits and cutting down on expenditures made using a credit card is mandatory. If not done, one can never get out of the loop which burns a hole in your pocket with high rates of interest on the outstanding amount. A full stop to purchasing commodities out of the budget, paying off the monthly minimum amount and deliberately skipping on credit card payments will help in building the foundation for increasing the credit score.

So Exactly What Could Help To Rebuild Credit History?/peoplerebuildingcredit_DrawnIdeas_IkonImages-56a1ded73df78cf7726f5e6b-5a9f1bdd3037130036763d58.jpg)

The answer is timely payments of outstanding bills most preferably in full is a good habit one can afford when the expenditures are well below the credit limit. One should not be ignorant of payments apart from credit cards, no matter how insignificant they might look like, for example, library fines, medical bills, etc. as everything counts. In this cyber age, companies hire collection agencies for recovering pending payments from customers which can turn ugly. Any account reported to the collection agencies by businesses is forwarded to the credit bureaus, who make sure that the stain stays on the credit report for an unbelievable 7 years which will leave the individual in a state of helplessness.

Don’t Go Overboard

During this tough phase of rebuilding, it is not recommended to acquire many credit cards, as the cumulative expenditures on all of them will attract a good amount of interest depending on the interest rates of the different credit cards which can range from medium to high when compared to the global trend. A maximum of two credit cards should be availed if required at all.

Which One Should You Choose?

Credit cards for poor credit or no credit do exist in vast quantities. Even though you are working on credit rebuilding or creation for the first time, that doesn’t mean that you should not get access to some fantastic features. The above cards have a lot to offer from a variety of companies that care about their customers very much. The bottom line is that complete payment of the outstanding amount before the due date without having to cut down on the expenditures on essentials is a quicker way to a better credit score. This is only possible by monitoring the expenses closely without going beyond the threshold set by the individual according to their income. So following the above-mentioned tips answers the questions of what could help to rebuild credit history and what other cards are available for those with a poor credit score