Homeowners Insurance For Bad Credit- Get A Low Rate Insurance Policy with Bad Credit

Find & Compare the Best Insurance Quotes Online for Your Home Today.

A home insurance policy can cover your home of course but home insurance coverage does come with a cost and especially for those with failing credit scores. Some may be shocked to discover their personal credit score contributes to high premiums. Addressing disastrous credit and improving a score could assist with getting both better policies and better rates on your home insurance. Homeowner’s insurance remains vitally important to those who wish to protect both their property and financial security. People commonly draw the bulk of their net worth from the value of a home. Homeowner’s insurance protects against losses and destruction to that property.

The Underwriting Process And Poor Credit

The underwriting process involves the insurance company looking at the risks associated with issuing a policy. Someone who previously filed a number of claims could prove to be such a high risk that the company chooses not to accept the application. The person may then need to apply for a surplus lines policy, a costly policy designed for high-risk customers. Various other factors are examined. Owning a dangerous dog, for example, creates a higher premium risk. So might a felony conviction and yes, poor credit factors into the underwriting process as well. Discovering a terrible credit score increases premium prices might come as a shock to many. Purchasing coverage on a home isn’t exactly the same thing as choosing to apply for a loan or credit card. Regardless, a bad credit score presents a profile to the provider that is not positive.

Troubled Credit And Concerns

A person with weak credit is likely to be a risk to an insurer. Years of industry analytics lead providers to determine applicants with poor credit come with added risk. Fair or not, a lot of people with bad credit may be lax in other areas of life. This can extend to taking proper care of a home which, in turn, creates more liabilities. Negligence leads to accidents and property damage. An insurer may not turn down someone with bad credit, but the applicant might be quoted a very high rate. The rate could even be near double than what someone with good credit would be presented with. Poor credit applicants find themselves in a bind. Not purchasing coverage becomes far too serious of a risk to take. They end up being forced to pay for higher premiums on a policy. Going without coverage could set the stage for a far worse financial disaster. Providers are generally obligated to pay when presented with a valid claim. So, home insurance companies must be careful about who they choose to insure. They must also charge accordingly. Someone with weak credit either has to deal with high premiums or work at bringing down the score.

Protect Your Home

Bad credit is something that many borrowers have a problem with, and it can certainly hurt the level of trust between you and your lender. If you are on bad credit, you know how hard it is to get another credit. This problematic situation can influence your ability to get home insurance as well.

What Is “Bad Credit?”

What it essentially means is that you have a record of not keeping up with your payments, and so lenders do not trust you enough to approve you for new credit. If you’ve taken too long to pay for your credits or if you are still in debt, you have bad credit. Home insurance can be very complicated for those who have terrible credit as no one is willing to lend them money. The personal credit score an individual possesses is an essential factor when getting insurance because trusted clients are offered better insurance policies and conditions. Most homeowners and families who possess a house in their names know the importance of home insurance, because unpredictable events, natural disasters, and accidents could very well diminish your house’s market value by a large percentage and the repair costs are high. Home insurance gives you additional protection against these accidents and allows homeowners who fall victims of such disasters not to freak out.

Property Insurance

Property insurance often covers all kinds of losses in the individual’s home, including loss of use for the contents and the house itself, but the most critical aspect is that it covers disasters and all of the things inside the house are accounted for. If you have bad credit in your name, there is a big chance that you won’t be accepted on their insurance policy because you pose a high risk. These customers that aren’t very trusted by the insurance company end up having to apply for a different type of policy. What homeowners insurance are available for those with bad credit? The surplus lines policy.

What Is A Surplus Line Producer And Why Is It Suboptimal?

Homeowners have to seek a broker or producer, which is licensed by the state and will act as the bridge between the insurance seeker and the provider, the insurer. However, in some cases, the request for insurance will not be accepted because of high-risk, suboptimal conditions or because it does not meet with their requirements and policy. In that case, if the producer is unable to find a licensed insurer for the homeowner, surplus line producers can come in handy. These are not regulated by the state and can search for policies from insurers that aren’t as well. If you are struggling with your credit score and with your financial situation, this ends up being your reality, but it is not optimal, as these insurance policies can be costly.

Will Paying Insurance Regularly Improve My Credit?

Yes, definitely. Your credit score depends on how well you can keep your payments regularly and if you’re able to pay for the insurance on time. There are other things that are taken into account when credit reporting agencies check your record, such as bankruptcy.

What If I Bundle My Insurance With Life Or Auto Insurance?

For those unaware, bundling insurance services mean buying multiple of these services from the same provider, essentially allowing you to get discounts, something that a significant percentage of insurance-owning Americans do with their carriers. It helps with your financial situation and with the management of your bills, but does it help with bad credit? Yes, it does, some insurance companies might give you a chance if you decide to bundle with them, but not if your credit history is too bad, as it still poses a risk.

What Can I Do To Improve My Bad Credit Situation?

Simple!

- Pay your bills on time. Be consistent with your payments and pay them in the due date. If you are really forgetful, you can set it to automatic billing; most companies have that option.

- Don’t let debt accumulate. If you allow them to grow, this practice decreases the value of your credit reports and show insurance companies that you pose a risk.

- Don’t get close to the maximum limit of your credit.

- Seek to pay for services without your credit.

- Find ways to fix your bad credit situation over time, with consistency.

- If you do get home insurance, pay the bills with consistency. Remember: Will paying insurance regularly improve my credit? Yes.

- Seek lower credit balances.

Does that mean that there are only bad options for those with credit reports that are less than optimal? No, not necessarily, but more comprehensive research must be done to find companies that are willing to accept the risks and offer you their services. What if I bundle my insurance with life or auto insurance? Offering these companies the opportunity to group with other services also increases their chances of cooperating.

Credit Improvement Plan

A credit improvement plan must be instituted without any delays. In addition to helping lower costs on premiums, improving a score should eliminate various other problems associated with poor credit. The process of improving a credit score might take time, which is why putting off taking the necessary steps remains a bad idea. Paying all debts on time can definitely help you rebuild your credit score. So does making arrangements to pay any previously-defaulted debts. High credit card balances drag down scores significantly. Revising a budget in order to direct money towards paying down the cards supports the cause as well. Those not sure how to succeed with their improvement plans may wish to speak with a credit counselor. An experienced counselor may be able to chart a path for those struggling to put themselves on a better financial footing.

Asking For New Quotes

As soon as your credit score improves, request a new quote on a home insurance policy and review several quotes. The improved credit score should bring rates down. If so, then switching to a less-costly policy might be worthwhile. Perhaps even the current provider may drop its rates. Just be sure to see if a better policy can be purchased before you go and start asking for new quotes on home insurance policies because too many quotes could hurt your credit score.

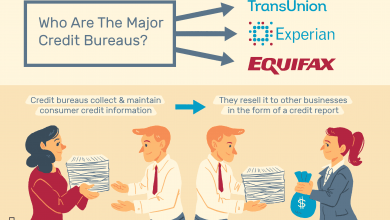

How Is The Credit Score Calculated?

The companies that collect your credit history are referred to as credit bureaus or credit reporting agencies, and they calculate what is called a “FICO score.” There is more than one type of score, and it depends on what company is looking at the report or what are their demands. These scores, however, if low, tend to make lenders less probable to accept deals with you. As of now, all kinds of insurance services have a hard time accepting requests from individuals with bad credit. It usually goes against their terms of policy, and users that do not receive such services end up having to seek the surplus line producers. Of course, when there is a lot of research involved until the homeowner receives the policy, it can be very costly as the company is not willing to take any risks.